I cannot tell you all how excited I am that this series is OFFICIALLY getting started! I have so much to share with you all in the next eight weeks. Here's a little bit of what to expect over the course of the program.

Every Monday, I'll be sharing a specific Budget Bootcamp post. Much like this post, each one will have a good deal of information and some action steps for you to take throughout the week. Each week we will build on what we learned and implemented the week before. I will link each week's Bootcamp post to our private Facebook group, and we will also use this group to share ideas and aask questions along the way.

You'll also see other posts happening on other days of the week that could tie into budgeting. Things like meal planning, meal prep, cost effective recipes, paying off debt, how to spot great sales, how to save on *fill in a million different things here*. You get the picture. Monday posts will be building upon one another and focused on creating our budgets, and the other posts sprinkled throughout will be a variety of things that can be inspiration for scaling back. Make sense?

I'd also like to take this opportunity to reiterate that I am NOT a financial advisor, accountant or any other form of professional money manager. I am simply sharing what I've learned and what works for us, and how I budget is by no means the only way to do so. Capiche? Great. Let's get to it, shall we?!

Today we are talking about defining our expenses. What do YOU or your household spend money on? If there's money being spent on it, it needs to be in your budget. So the best place to begin is by listing them out. I like to list our expenses in three categories - Fixed Expenses, Variable Expenses, and Annual Expenses.

Fixed Expenses:

This category includes anything I get a reoccurring bill for. For my family, this category includes:

- Mortgage

- Property Taxes

- Homeowner's Insurance

- Van Payment

- Electricity

- Natural Gas

- Water/Trash

- Internet

- Netflix & Hulu

- Cell Phones

Yes, I am aware that my electric bill will probably not be the exact same amount every single month, however it doesn't vary significantly and I'm going to have an electric bill every single month. Same with the water/trash and natural gas. But, what I do know is that expected bill amount, so that is the amount we budget for. Our mortgage company pays out our property taxes and our homeowner's insurance from our escrow, so we send one payment each month that covers those three items. We also don't have cable in our home, so Netflix and Hulu are listed because that's what we use.

Your fixed expenses may look very similar to ours, or they may be vastly different. If you are a renter who's water, natural gas, and trash are all included in your rent, then your budget should reflect that. If you have other outstanding debt such as student loans that require a minimum monthly payment, list those here also.

Variable Expenses:

These are the things you spend money progressively throughout the month. Unlike the fixed expenses, you don't get a bill to pay and be done with. These are the categories that most people indicate they over spend on. And why is that? More often than not, its because these expenses get away from us. For example, groceries. $50 here, $40 there, $80 next week, $35 two days later because we forgot things or didn't plan ahead.... see where I'm going with this? These expenses can quickly blow your budget if you aren't paying attention. So in this category, create smaller, more specific categories that

everything else you buy will fall into. The more specific, the better. Here are ours:

- Groceries

- Gas

- Eating Out

- Home

- Paper & Cleaning

- Personal Care

- Plexus

- Clothing

- Gifts

- Garden & Crafts

- Transportation

- Entertainment

- Pets

- Automotive

- Miscellaneous

Now, the thing to recognize about Variable Expenses is that there may be some months you

don't spend in one of these subcategories. For instance, we may not need to purchase toilet paper, razors, toothpaste, or any other similar products in January because we have plenty. So in that case our Health and Hygiene category may have zero expenses. Our transportation category is for things like replenishing our IPass funds and for cab fares/Lyft/Uber when we use them. We very well could have numerous months throughout the year that those categories see little action. My personal rule of thumb is to designate funds toward what we realistically anticipate spending on, and if those funds aren't needed, then great, extra to the savings account that month! If you have a coffee habit twice a week or girl's night's twice a month, you should create a budget for yourself for those things. The miscellaneous category should be used as little as possible and for things that truly fall in no other category. Supporting the neighbor girl selling Girl Scout Cookies would fall under miscellaneous. A parking or spending ticket could go under miscellaneous. Miscellaneous should not be code word for "I went over budget on clothes/makeup/groceries so I'll just claim the rest of it over here." The only way to know where you can and need to cut back is to be honest, transparent, and specific about what you spend on.

And last, but definitely not least...

Annual Expenses:

Annual expenses are those things that you pay for once or twice a year, not monthly. These are still expenses, none the less, and they need to be accounted for. If you don't budget for them, you'll be wondering where on earth that money vanished to. Ours include:

- Annual Costco Membership

- Amazon Prime

- Filing Taxes

- Truck Insurance

- Van Insurance

- Sticker Renewals

We pay our auto insurance in full every six months to save an additional chunk of change. If you don't do this and your insurance company offers a discount to do so, I highly recommend it - great way to start saving yourself money easily. However, if you make monthly payments on these things, be sure to list those under fixed expenses instead. Sticker renewals is a subcategory that I didn't use to have listed. But it didn't take many of those little papers in the mail from the state asking for their $101 to make me realize I needed to account for this!

So, this week's task for you all is to sit down and create your budget outline. Define all your categories and be as specific as possible. You can do this on notebook paper or Excel if you prefer, or I've provided a template for both hand written and digital budgeting as well. Whatever works best for you! And those receipts. Keep keeping those receipts. We will be putting them to use next week!

For those wanting to print out a template to fill in by hand,

click here! In the "BUDGET" column, write in what you are striving to stay under. We will be assessing those receipts next week and adjusting as necessary to make sure our ideal budgets are realistic.

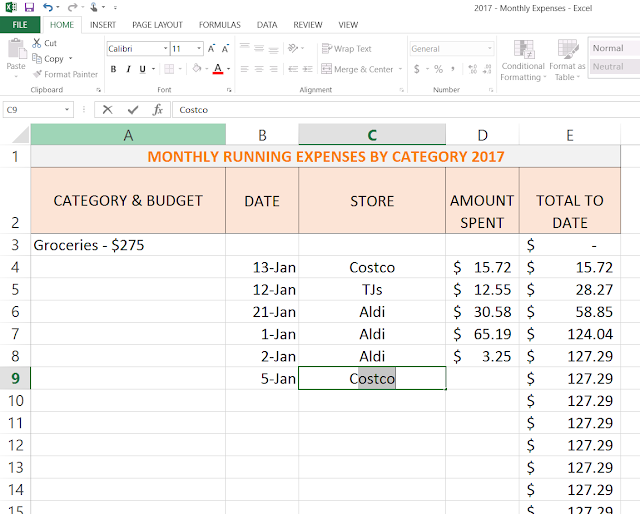

For those of you opting to use the Excel version, please follow these instructions!

- Click HERE to open the Google Sheet. The perk to using Excel is that I have pre-entered all the formulas to

calculate your spending totals each month for you. For those of you who

aren't super familiar with Excel, I'll be uploading a video to our

Facebook group soon to help walk you through what's happening here :)

- Immediately go to FILE, then DOWNLOAD AS >>>> Then click MICROSOFT EXCEL. If you skip this step, any changes or entries you make to the Google Sheet will save back to MY files. You want to have saved this blank template BEFORE you begin making your own entries.

- On the left, you will see all my categories entered. Go through and replace them with YOUR categories of spending. Be sure to SAVE your file after working on it. You'll want to enter your categories on the first page (months January-June) and the second page (July-December) in the SAME ORDER so that the program can accurately calculate for you!

- In the column just to the right of your categories, you'll see cells highlighted in yellow. In each of these cells, write in what dollar amount you are striving to stay under each month. We will be assessing those

receipts next week and adjusting as necessary to make sure our ideal

budgets are realistic. You'll see that the top yellow cell in this column will automatically total all your categories for you! Only enter your budgeted totals on the first page; the second page will automatically fill for you!

So get to it! Create those categories, think critically about your spending, and fill in your planned budget for each category. You're on your way to better money management!