Remember how I had you keep all those receipts since the beginning of January? Now this is where you make use of them to determine whether your habits are within budget and whether your budget is realistic. What we are going to do is go through those receipts one by one and enter our purchases into the category they belong to. This might seem overwhelming at first, but it doesn't have to be, I promise. Like most daunting projects in life, if we break them down into smaller, more manageable tasks, suddenly they are easier to accomplish! So here's how I do it. I grab my basket of receipts, and I separate them into small piles. I like to do this either at my desk or at the dining table so that I have room to work. Many times, just looking at the store name at the top of the receipt will quickly indicate to you which category/pile it belongs to. Things like Home Depot, Pet Smart, and Old Navy are almost always going to belong to Home, Pets, and Clothing respectively. Stores like Costco, Walmart or Aldi, however, might have purchases from multiple categories all on our receipt - Groceries, Home, Personal Care, and Gifts might all have a part of this receipt's total. Following me?

So what I do and find simplest, is to flip through my receipts and start creating little stacks that I can quickly identify, like Home Depot, Menards, and Lowes - all go in a stack together. Any fast food or restaurant receipts go together. You getting it, right? And then for those "one stop shop" type stores, I glance quickly over them to determine if they are a combo of things or just one category. Aldi receipt shows milk, spinach, oats, carrots, apples, hummus and pasta sauce - Great! Straight to the grocery pile! But if that same receipt had things like batteries, trash bags and toothpaste on it, then it would start what I call my "combo" pile. I hope all this is making sense, but just for good measure, here's a visual of what that looks like. :) The stack at the top of the right photo is my "combo" pile.

- Option One - Calculator and Pen. This is probably the most straight forward of the ways. Just grab a calculator, take each pile of receipts (Home for example) and add up what your receipts show you spent. Write this number down on a blank sheet of paper or a notebook.

- Option Two - Hand Itemizing. This way is probably the most time consuming, but is a happy medium between Option One and Option Three. You're still using a calculator and pen, but you're more making a better record of how many purchases were made and where they were made every month. For example, if I saw that we spent $67 eating out in December, that's one thing. If that $67 is comprised of 8 trips to Taco Bell totaling $54, that I see an issue with. See how knowing the details makes a difference? So grab a notebook or legal pad and under each category, jot down the date, store and total.

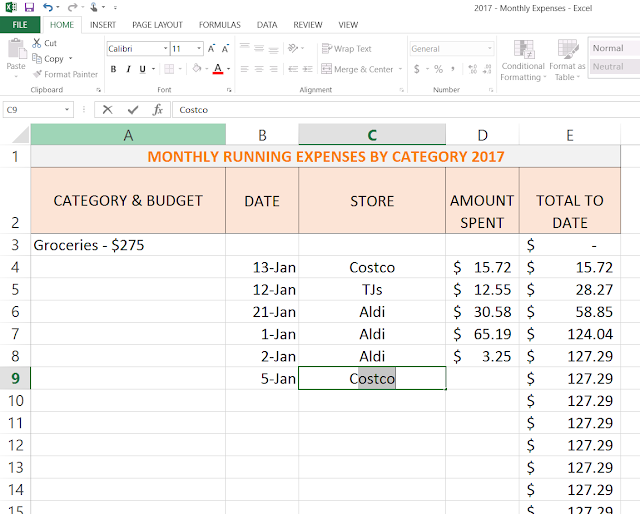

- Option Three - Letting Excel do the work. Have you realized I like letting Excel make things easy on me? This method gives all the details from option two but without the hand cramps or paper waste and, bonus, Excel adds it all up too, so no calculator required. And if you have entries that repeat, *cough* 8 trips to Taco Bell *cough*, Excel will auto-fill the store name after only typing the first letter or two, like "Ta..." You can see what I mean by this below where Costco is being entered. Click here to download a spreadsheet that I use. Be sure to do the FILE >>> DOWNLOAD AS steps just like last week before entering any information.

So now that all your expenses thus far in January have been assessed, how do things look? Are you on track to stay under budget this month? Is there a category you maybe need to freeze your spending on for the rest of the month? Look things over and see where you stand. We've still got over a week left in the month, so be sure to continue keeping receipts and add them in. January serves as a nice warm up for us; we get to work out some kinks now so that we can stick to the budget come February!

No comments:

Post a Comment